Setting up a business as an entrepreneur includes an onerous process of background work to get the ball rolling. The stakes get higher when it comes to scaling your business. It requires planning, setting up the right systems, staff, technology, processes and many more. At the heart of all these, is funding, the lack of which poses a huge threat to startups, entrepreneurs, and their businesses.

Boast.AI gives you an edge where you can seamlessly access Research & Development (R&D) tax credits to secure the necessary funding your business may need to continue growing and ultimately scaling, sustainably. Lloyed Lobo, the co-founder, and president of Boast.AI shared the details of how this FinTech works with Alicia Butler Pierre during this interview on the Business Infrastructure Podcast.

R&D Tax Credits and Boast.AI

An R&D tax credit is a type of tax incentive issued by the government to businesses that spend resources on research and development activities. This simply means that if you are developing new technology or improving on existing ones, you can get about 10% of your expenditure back.

In the U.S., R&D credits are filed alongside your tax returns. If you own a small business with less than $5 million in revenue, then you can use those R&D credits to offset payroll taxes and get cash back. Payroll returns are also filed quarterly.

Interestingly, a lot of money in the form of tax credits and grants go unclaimed annually. While some entrepreneurs are aware of these opportunities, they are put off by the rigor involved in accessing them.

Boast.AI automates the process of identifying and claiming R&D tax credits as well as other government incentives for companies. The software helps to identify claims, streamline the process, and defend and provide audit services for businesses.

It works by pulling your company’s technical information and stitching it with your payroll, financials, and banking systems to unlock associated government R&D tax credits and incentives. In the future, Boast.AI will be able to offer business insights and intelligence for your company such as who to hire next, how to innovate faster, and which projects are generating ROI.

How it Works

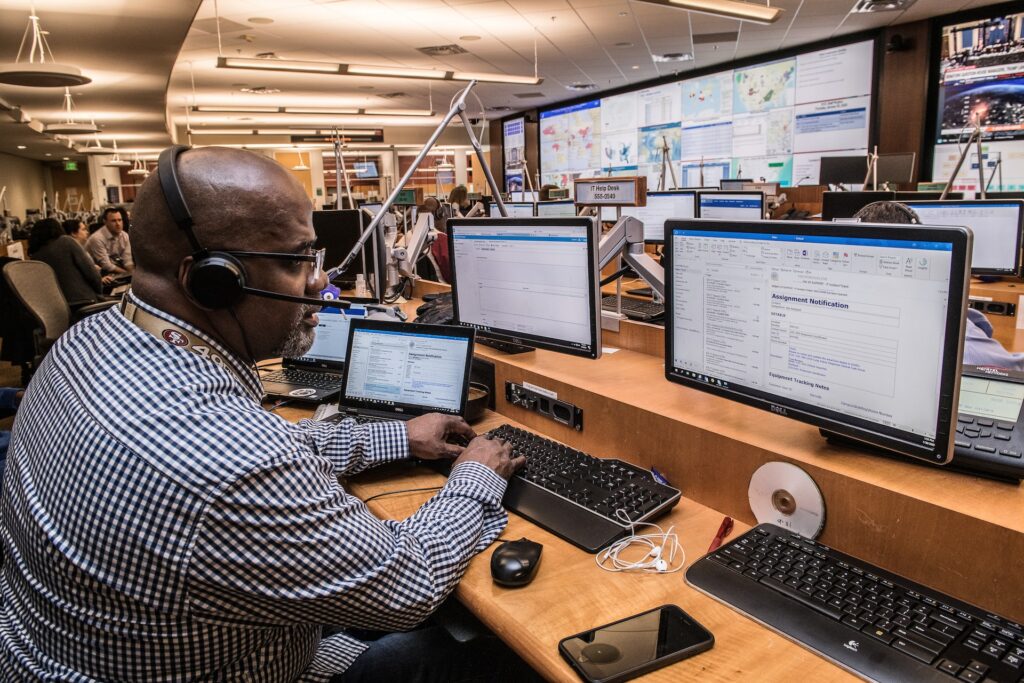

When you subscribe to Boast.AI, the platform integrates with your company’s technical and financial systems. It then extracts required data throughout the year in real-time after which, the system deploys artificial intelligence (AI) algorithms to figure out what projects were worked on and how much time was spent on them during the year under review. After the data has been recovered, the team at Boast.AI leverages it to process your claim.

If your company has been audited by the government, Boast.AI can access the entire audit trail from their system. After collecting necessary data, Boast.AI can also offer you the option of getting a cash advance against the R&D credits you qualify for. This activates the cash advance you can use to fund further innovation in your business.

Systems Integration and Customer Success

Boast.AI integrates with systems like JIRA, GitHub, and Asana to figure out how your company performs R&D projects. It also considers the timeline for performance, including time spent on these projects by your employees.

The platform easily integrates with csv files exported from other systems. On the accounting side, Boast.AI integrates with QuickBooks and Sage. For payroll, the platform integrates with Gusto, ADP, and about 10 other systems to pull the required data. With the various system integrations it offers, Boast.AI takes a 360 degree view of your company. One unique feature that distinguishes Boast.AI from other fintech platforms is its ability to stitch technical data with financial data.

The platform easily integrates with csv files exported from other systems. On the accounting side, Boast.AI integrates with QuickBooks and Sage. For payroll, the platform integrates with Gusto, ADP, and about 10 other systems to pull the required data. With the various system integrations it offers, Boast.AI takes a 360 degree view of your company. One unique feature that distinguishes Boast.AI from other fintech platforms is its ability to stitch technical data with financial data.

Boast.AI has a team of customer success personnel that includes engineers who look at the data generated from its systems, maneuver it, and create the needed reports and claims. This team serves as a channel of communication between customers and the government.

Final Thoughts

As an entrepreneur looking to scale your business, you can leverage the numerous opportunities that R&D tax credits provide. With the right tracking and preparation, this gives you quick, legal access to additional funds for your business. If you are an innovator in the technology space or have a functioning product that requires additional development, then what are you waiting for?

Familiarize yourself with the Boast.AI ‘s bespoke services to secure R&D tax credits for your business.