Transcript

Welcome back to Season 23 of the Business Infrastructure Podcast. On this show, we share operational tips, tactics, and strategies to help you cure any back-office blues you might be experiencing.

If you’ve been following along then you know that this season is dedicated to growth strategies. It’s structured as a masterclass featuring experts and tools to scale your operations, revenue, and profitability. As each subject matter expert is interviewed, I follow up with a monologue like the one you’re about to hear so that you have the benefit of knowing how to apply the information shared by each expert.

In the last episode, you learned about yet another strategy for growth, but it came with a twist – it involves growth through selling your business. In this episode, I’ll share with you what is turning out to be my personal five-year journey towards selling. Don’t worry, it doesn’t mean that the business is going away…quite the contrary!

This is Ep. 295: Scale to Sell – How I Plan to Exit the Business I Founded and Love

It’s always a pleasure to be with you one on one. If you’re new to the show, welcome! I’m Alicia Butler Pierre, Founder and CEO of Equilibria. Again, Equilibria is the underwriter of the business infrastructure podcast.

And this is the company that is the subject of this episode.

You see, I began thinking about selling my business about three years ago. There’s several reasons why.

- I have ideas for other businesses I’d like to pursue.

- I’m getting older and am at a point where I want to share my knowledge in ways other than consulting, and

- I’m ready for the Freedom 2.0 that Carl Nicpon talked about in the last episode!

Equilibria, as of this recording, is still largely a consulting firm offering operations management and business infrastructure services. And don’t get me wrong it has been an absolute joy working with all the amazing clients we’ve had over the past 19 years.

But…consulting is a grind! Long hours, travel, and sometimes you get so busy with work that you can literally wake up one day and wonder, “Where am I? How did I get here?” That literally happened to me one day.

I knew something had to change and that’s when I thought about selling the business. However, the business relied heavily on me which makes it practically impossible to sell. That’s when I started thinking about the training business model.

The shift from consulting to training is attractive for many reasons:

- I can easily find others who have the training skills required to perform the work

- It’s a shorter sales cycle

- It’s a shorter delivery cycle, and perhaps most importantly…

- It’s scalable!

So, as we’ve gone on this growth strategy journey together this season on the show, there’s another goal to sell the business by the time I turn 50. It’s 2024 and I’ll turn 48 this year. So that means I have two more years.

You know the strategy for leveraging an online course and training to facilitate growth at Equilibria, but now I’d like to share with you my plan for selling Equilibria.

Do you have a hobby or business? That’s an interesting question, and it comes from a chapter in a book called The Courage to be Profitable by Ruth King. And it’s one to really think about. I realized the first 13 years of my business was built around me. My personal brand and business brand were so intertwined that you couldn’t distinguish between the two.

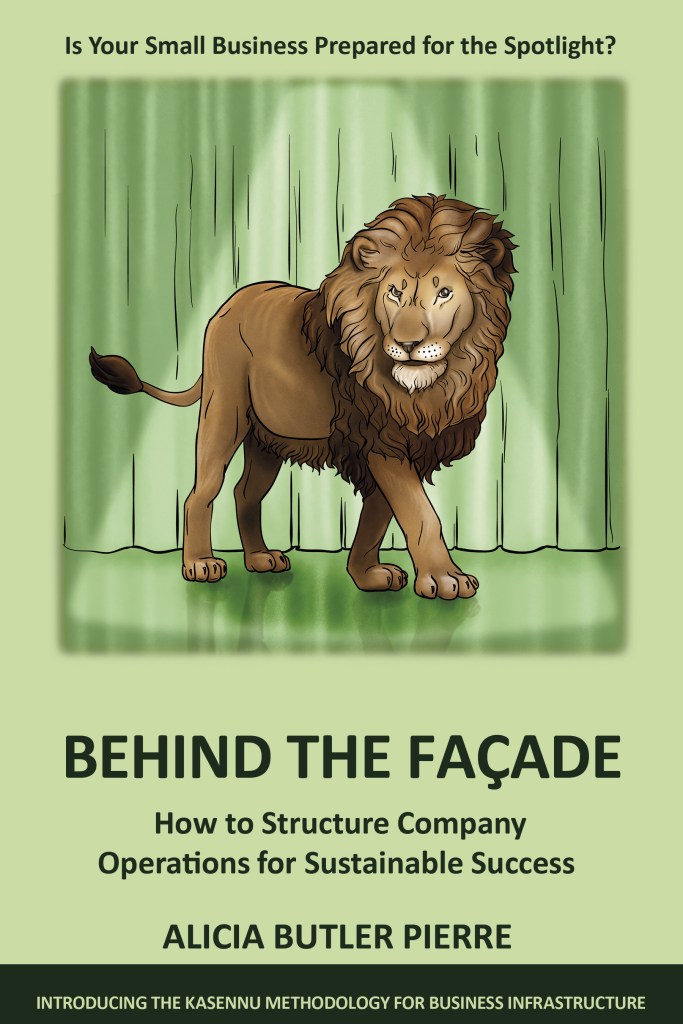

And as we know, that actually diminishes the value of a business. So the question became, how do I fix that? I knew that the end game was to sell, and I needed to get myself on the path toward that. Here’s how it started, and the story I’m about to share is really an abbreviated version of a much, much longer story, but here goes. The very first thing that I did when I realized just how dependent my business was on me is I wrote a book.

And that was my attempt to get knowledge out of my head, formalize this framework that I had created for building business infrastructure. And that was in 2018. That was also the year that I started this very podcast, the Business Infrastructure podcast. And I’ll be honest with you, I was on a roll with all of the speaking engagements. Referrals were coming in.

It was a good thing, but the business still relied very heavily on me. So I was able to get the information out of my head and into a format that could technically be shared with the masses via the book and also the podcast. But when it came to the consulting, the thing that was really bringing in the money into the business, it still relied on me. And then two years later, in 2020, the COVID pandemic happened. And I’ve said it before on this show, it was a blessing in the sense that I could finally realize my vision of a fully remote operation, and I was able to get the funding that was needed to digitize more of my company’s operations.

So, these were two things that I’ve been trying to do for a long time, and people would honestly look at me like I had two heads. But the pandemic really accelerated the push towards digitization and funding became a lot more accessible during that time. So, during the pandemic, I started to hire a core team of people, and over time, I was able to start delegating more and more of the administrative, financial, and other non-operational tasks. Now, notice I said non-operational tasks.

That’s a problem, because by the end of the pandemic, I was still doing all of the consulting in the business. And don’t get me wrong, there’s a team, yes, of people that handles marketing related things, social media, accounting, and day-to-day administrative things, including an entire team we have built around this podcast. But the operations is a core function that still did not have any delegation. It still relied on me, solo dolo, as they say. But I knew that if I wanted to train other people on this framework that I’ve built for business infrastructure, it would be a heavy lift.

And that was the motivating factor for creating the online course. Now, at this point, you all know the stories I’ve shared in the other monologues in this season on how the course led to the business model shift from consulting to training. Now that you know that background, I’ll be honest with you, I’m not ready yet for a business valuation to understand what Equilibria is currently worth. And the reason is because I want to make the complete transition from consulting to training first. Like, I really want that to happen.

See just how successful we are in that really get the revenue and the cash flow going before I work with Carl in getting an actual valuation for the business. And as a reminder, I plan to this, this plan, this growth strategy that we’ve been talking about all throughout this, this season, I plan to have that in place by the end of this year, 2024, no later than the first quarter of 2025.

Now, I don’t know if you remember, just, but just a quick detour. There was something that Carl Nicpon said during his interview. He said, listen, you only get one shot at this.

And he’s right. You only get one shot to sell your business. So, make sure that you position your business so that it can be sold at maximum value. He also said something else that made me chuckle, because he said, there will be no shortage of people who will promise you all kinds of things regarding selling your business. And that was funny to me because seriously, for about the past three years, at least once a week, I receive an email like the one I’m about to.

I received actually, this morning, right before I started recording this monologue about people who offer, you know, the ability to sell your business at maximum value, and they really don’t even know you or your company or what your company is all about. They’re just, they’re just out there fishing for business, hoping that someone will take the bait. But I’m going to read this email to you. I literally received it this morning, 08:57 a.m. eastern time.

It is July 3 that I’m actually recording this monologue. The title of this email is looking to sell equilibria. Here’s the body of it.

“Hello, Alicia. We just helped another founder sell their e commerce business for $3 million. Interested in selling for six to eight figures. We have over $6 billion worth of buyers ready to go.”

And this comes from someone named Vlad with a company called Epoch Equity. Now, I have no idea if Vlad is a real person or whatever epoch equity is, you know, if it’s a reputable company or not, but it just goes to show that these inquiries come and they come very frequently. But again, I know I’m not ready yet to sell the business.

And even if I did try to go down that path, I certainly wouldn’t get a lot of money for it, not with it being so dependent on me and my daily presence. So, back to this journey. I do know that before I approach Carl, there are two primary areas that I want to focus on to prepare for the valuation that Carl offers through the firm where he works, which is called Marsh Creek. The first focal area is business infrastructure. Now, surprise, surprise, that is what Equilibria does.

But we actually need to strengthen our own business infrastructure. Again, business infrastructure is simply a system for linking your people, processes, tools and technologies so that growth and scale can happen in a profitable, repeatable and sustainable way. As far as the people element is concerned. As you all know, again, from being on this growth journey with me this particular season, one major way that we are investing in people is via key partnerships. We also have a consortium of independent contractors who can provide the training that we are going to be offering now through Equilibria.

But there’s also that core team of people that we have with equilibria. My assistant, there’s a production assistant. There’s some folks who make up the core team. So those are the people that are involved and will continue to be involved as we start to solidify our business infrastructure. From a process perspective, we have actively been documenting our processes for about the past two years.

This isn’t actually three years ago. This is not for the fainted heart, let me be honest with you, because it’s not that documenting processes is hard. It’s the fact that you still have a business to run. There is still the regular work that has to be done every day. And documenting processes is something that in addition to the work you’re already doing, you have to carve out even more time to make sure you do it.

But I can promise you, you, once you do that, it is so worth that extra time that you have to add to your already full workload. But it does take a while. Unfortunately, many of us are not in a position, myself included, to be able to just take off, let’s say 90 days, and just get as much documented as we possibly can. So we spread it out over time. Regarding the tools and technology element of business infrastructure, this is also a key component of our documentation.

So, we use Notion as our main operating system and our overall tech stack, if I had to call it a tech stack, it includes a number of other technologies that are associated with each of the main functions of our business. So, including accounting and HR and marketing, things like that. Part of documenting our technologies, one of the things that we do in Notion is we are very clear about usernames, passwords, who has full access rights, who has view only rights, who has editing capabilities, things like that.

We’re also starting to document how some of these technologies actually link to others. And something that has been a painful lesson to learn very recently is the importance of documents, documenting how the website is hosted, where the domain has been purchased, and all of those other technical details that sometimes we forget whenever we’re switching a service provider, and it comes back to bite us in the end.

So that’s why we also are taking even more time to document the technology pieces of the business as well. So that’s the business infrastructure focal point. The second focal point are the financials, which is the obvious, right? This is what Carl Nicpon focused on pretty extensively in the last episode, and it’s a huge area to focus on. And unfortunately, we don’t have time in this episode to delve into all of those details, because I don’t want this episode to go on indefinitely.

But what I can share is that we have the following things in place here at equilibrium, and it took us about a year to get all of this in place, and it was painful. Again, I’m not going to sugarcoat this. For those of you listening, it’s not fun. It is not a pleasant process. It’s a lot of work.

One of the things we started doing is we started documenting the key metrics that we needed to measure and monitor on a monthly basis. Some of those metrics include one that Carl actually mentioned, which is EBITDA. E-B-I-T-D-A. That is definitely an accounting term. If you’ve never taken an accounting course, this might be foreign to you.

Or if you’ve never been in the world of funding or venture capital, or trying to raise money, you may not be aware of that term, but again, it stands for Earnings Before Interest, Taxes, Depreciation and Amortization. I’m not an expert in EBITDA, but I will say this. Definitely make sure you talk to financial folks and they will definitely be able to explain it to you. Also, use some of those AI tools to learn more about what EBITDA is and figure out how you can start measuring your company’s EBITDA. Some other metrics have to do with aging accounts receivable, cash flow, liquidity, and things like debt-to-equity ratios.

These metrics took us a while to define and really govern both our operational as well as our marketing activities. These metrics are also tracked on a dashboard. So that took a while for us to develop the dashboard as well. And now it’s something that is looked at every month. But I’m also going to be honest with you here.

It’s not until you plot those metrics, those numbers into some type of bar chart or line chart, that you start seeing things like peaks and valleys, trends and patterns. If you’re just looking at numbers from month to month, you can get a sense if something is going up or going down. But if you really want to start seeing again things like patterns and trends, it always helps when you can start plotting those things. So that took a while also to figure out how to get those bar charts embedded into an Excel file, which is the tool that we use to create our dashboard. I know there’s other way more sophisticated tools out there, but for us, this was something that we already had and didn’t have to invest extra money in.

So, until we are able to upgrade into a more sophisticated technology, for now we’re using Microsoft Excel. We actually export data from QuickBooks. That is the accounting software that we use. QuickBooks doesn’t have the in depth, I would say, charting capabilities that we would like to see. So, from a dashboard perspective.

So that’s why we just make sure that we export data into a csv file and that is then brought into excel and that’s how we’re able to start really getting these fancy charts that we look at to help govern again, both operational as well as marketing related activities. Another thing that I should mention, I know I said there were two main focal points for us, which is business infrastructure and the financials. But something else that I do want to mention is that funding might also be required for us to achieve the business infrastructure and the financial health that’s necessary for us to scale and ultimately sell equilibria funding. As I’m sure you can imagine that’s also a really huge topic to tackle and unfortunately is outside of the scope of this conversation. But again, there’s no shortage of resources out there vetted, valuable, credible resources about funding.

Like Carl Nicpon mentioned, I learned much of what I do know about selling a business from other people. So I don’t know if you remember this from his interview. He said, honestly, the best way to learn about how to sell your business is to talk to other people. Talk to those business brokers that he, he mentioned. Talk to those Mergers and Acquisitions or M&A advisors.

Talk to those investment bankers. Even if you happen to be listening to this and your company is in that upper echelon in terms of profitability and revenue, and you would actually work with an investment banker and not an m and a advisor or business broker. So, I learned much of what I know from folks like Carl and in addition to other people in my network, like David Shavzin and Karen Mills and Jeff Musgrove. These are all people who have also actually been on this podcast. So, we’ll make sure that we have links to their, their podcast interviews in the show notes as well.

But I do want to recommend some additional books. I know Carl did a great job of mentioning the e myth as well as built to sell, but I do want to recommend some additional books to help you prepare for selling your business or prepare to sell your business. The first one is my book, actually, Behind the Façade: How to Structure Company Operations for Sustainable Success. It really does spell out the framework for how to create business infrastructure that is going to give you the foundation to actually scale your operations and make sure that you have a business that does not rely on you for its day-to-day existence. Another book is called Secret Service: Hidden Systems that Deliver Unforgettable Customer service.

And that book is by John DiJulius. I really love that book. Another book is one that I mentioned earlier in this episode is The Courage to be Profitable: Get and Stay Profitable in Less than 30 Minutes a Month. And that book again is by Ruth King. I actually know Ruth, and in her book she lists ten ratios she recommends for analyzing your company’s health via your financial statements.

So, I highly recommend that book. It’s a very easy read, and one that I think you will probably find you’ll just keep on your desk for quick referencing. And the final book that I’d like to recommend is called scaling up how a few companies make it and why the rest don’t. And that is by Verne Harnish these two areas alone. Again, so this is business infrastructure and the financials.

Again, this is from Equilibria’s perspective, but you might have to have a different assessment for your own company. Rest assured; the financials absolutely is a part of it. And I can promise you, business infrastructure is a part of it or not, whether you refer to it as that or not. Business infrastructure is definitely a part of it. But beyond that, there might be some additional things that you too may want to focus on before you pursue a valuation of your company or just to understand where you are right now.

It doesn’t hurt to get that valuation. It gives you a really good idea of how close or how far away you may actually be from having a business that can not only successfully operate without your daily involvement but is also ready to sell for maximum value. And this is what we here at Equilibria will spend the rest of this year, and likely all of 2025 and 2026, working on as we prepare the business to sell. Don’t forget about that X-matrix, right? That X-matrix takes us all the way into 2026. And I’ve already told my core team that my goal, my goal is for all of us to become multimillionaires by the time we sell Equilibria.

And of course, this does not mean the end of the road for any of us. Most business sale transactions require the founder of the business acquired to remain on board for another year or two to assist with the transition. And the existing core team is so awesome at what they do, and they’ll likely be in a position to also determine if they want to stay or move on to something else when that time comes. Either way, it will be a win-win situation for everyone involved. But we’re all clear that it will take a lot more hard work to get there.

But as the saying goes, no pain, no gain. I want to close by sharing a quote with you. It’s something I heard while listening to an interview of Steven Pressfield. He is the author of the book called the Legend of Bagger Vance, and there was also a movie that was created based on his book. I’ve actually written this down in large letters on a whiteboard in my office, and I look at it every day.

He said, “Fortune favors the bold,” and I not only believe that to be true, I know it’s true. So go out there, be brave, be resilient, and be bold!

Thank you for listening! Visit BusinessInfrastructure.TV to watch the video version of this episode. Again that’s BusinessInfrastructure.TV.

If you are enjoying being a part of this growth journey with us, then please subscribe to the show, give us a five-star rating and…please, leave a review. It’s the only way we’ll know what you like about the show.

If you want to sell your business, then take up Carl Nicpon on his offer for a complementary valuation. Go back and listen to his interview on this show if you haven’t heard it already. It will be well worth your time.

Next up is our last stop on the growth strategies masterclass and it features our last expert for the season. She’s going to talk to us about the importance of building a personal infrastructure as both a foundation and compass to ensure your business growth strategy aligns with your personal development strategy. Interesting concept, right? Well, it’s an even more interesting conversation. One that I think you’ll find refreshing too!

Be sure to come back to the place wherever you’re listening so you don’t miss it! Until then, remember to stay focused and be encouraged. This entrepreneurial journey is a marathon and not a sprint.

This podcast episode was written and produced by me, Alicia Butler Pierre. Audio editing and sound design by Sabor! Music Enterprises. Video editing by Gladiola Films. A special thank you to the team here at Equilibria, Inc., and to Grant Revilla for creating the show notes.

This is the Business Infrastructure – Curing Back-Office Blues podcast