No one likes to waste time or money.

Sadly, many of us become victims of time and money robbers especially during the first quarter of the year. Why? This is when we are usually setting goals, developing strategic plans, reviewing budgets, projecting sales, promoting products and services, etc.

With so many competing interests it’s difficult to figure out how to prioritize where and how to spend time and money. But one thing’s for sure…

Your businesses tax returns must be filed on time or else you suffer penalties and late fees.

Fortunately, there are some tax hacks you can use to cut time and money in preparing for and filing your business tax returns. Here are three of them:

#1: The Process Shop® – Tax Preparation Template

This template provides a logical sequence of tasks to perform that, if followed, ensures your returns are complete and filed on time. It contains a series of questions to eliminate as much guessing as possible as you gather the information needed to file your businesses federal and state returns. By gathering information in the right order, you save time and can focus on other priorities. And the less time your CPA, Accountant or Tax Preparer spends organizing and preparing your information, the less money you spend for their services! Start saving time and money with this tax hack now.

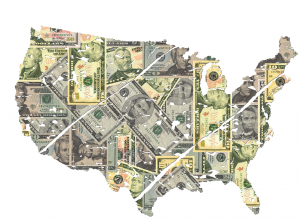

#2: Department of Revenue – State by State Guide

Where did you make your money last year? The answer to this question is just as important to the IRS as how you made your money. This guide’s tabular format allows you to quickly locate a particular state and then click a link to that state’s Department of Revenue (or equivalent office). There you’ll find specific tax return filing dates and other guidelines for that state. Once you have your tax preparation template, you’ll see how easy it is to cycle through the information-gathering process for each state where you conducted business. Click here to access the guide along with other invaluable details about taxes vs. tax returns.

Where did you make your money last year? The answer to this question is just as important to the IRS as how you made your money. This guide’s tabular format allows you to quickly locate a particular state and then click a link to that state’s Department of Revenue (or equivalent office). There you’ll find specific tax return filing dates and other guidelines for that state. Once you have your tax preparation template, you’ll see how easy it is to cycle through the information-gathering process for each state where you conducted business. Click here to access the guide along with other invaluable details about taxes vs. tax returns.

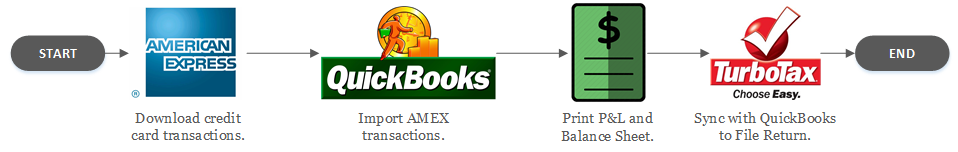

#3: AMEX, QuickBooks, TurboTax – Data Synchronization

American Express (AMEX), QuickBooks and TurboTax all have features that make filing tax returns easier than ever for small businesses. The flowchart below illustrates this seamless flow of tax information.

You can start by downloading your AMEX credit card information and import directly into QuickBooks. Set up time in QuickBooks is minimal and will save you or your bookkeeper a lot of time in manual entries. If you do a good job of syncing the data throughout the year, all you should have to do at year-end is print your Profit & Loss Statement and Balance Sheet. I recommend printing because it’s easier to reconcile against any potential errors that may arise once you use TurboTax. Once you’re satisfied with the information in QuickBooks, you can easily download TurboTax and sync it to your QuickBooks file. Depending on the complexity of your business, TurboTax may not work as a filing solution for you. Regardless, you can still use the AMEX and QuickBooks sync capability to significantly streamline your bookkeeping process.

_________________________________________________________________________________

Beat the annual stress of filing tax returns. If you do business in America, get started today with your tax preparation template! It’s a foundational shortcut that leads to other shortcuts. The more shortcuts you use, the less time you spend gathering information and the more accurate your information becomes. These hacks may not save you money on actual taxes, but it certainly will save you time and money in filing them.